Our strategy is simple, we invest in stabilized, Class A MultiFamily properties in major growth markets around the country. When we acquire new properties, we keep the current property management team in place to not disrupt the stability of the asset and to keep overhead low, we outsource everything we are not experts at.

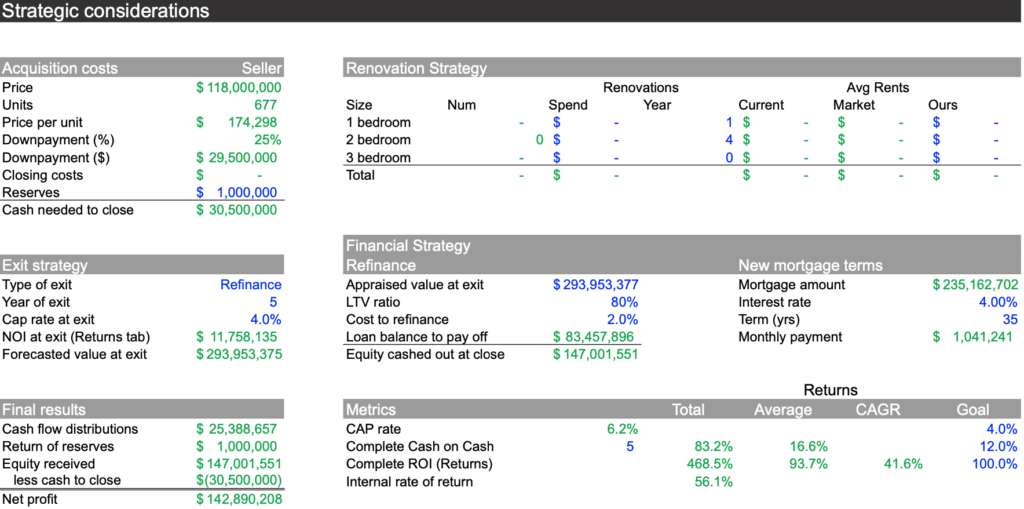

With technology today, it is easy to acquire and manage MultiFamily properties that have already been stabilized by another investor. Then by systematically increasing rents over time and using the cash flow generated by the property to make capital improvements, we can further improve the value of acquired properties. After a five to seven year hold period, we refinance out profits and invest in more property.

Our mentality is to hold properties long term and to bring on Investors who want to do the same!

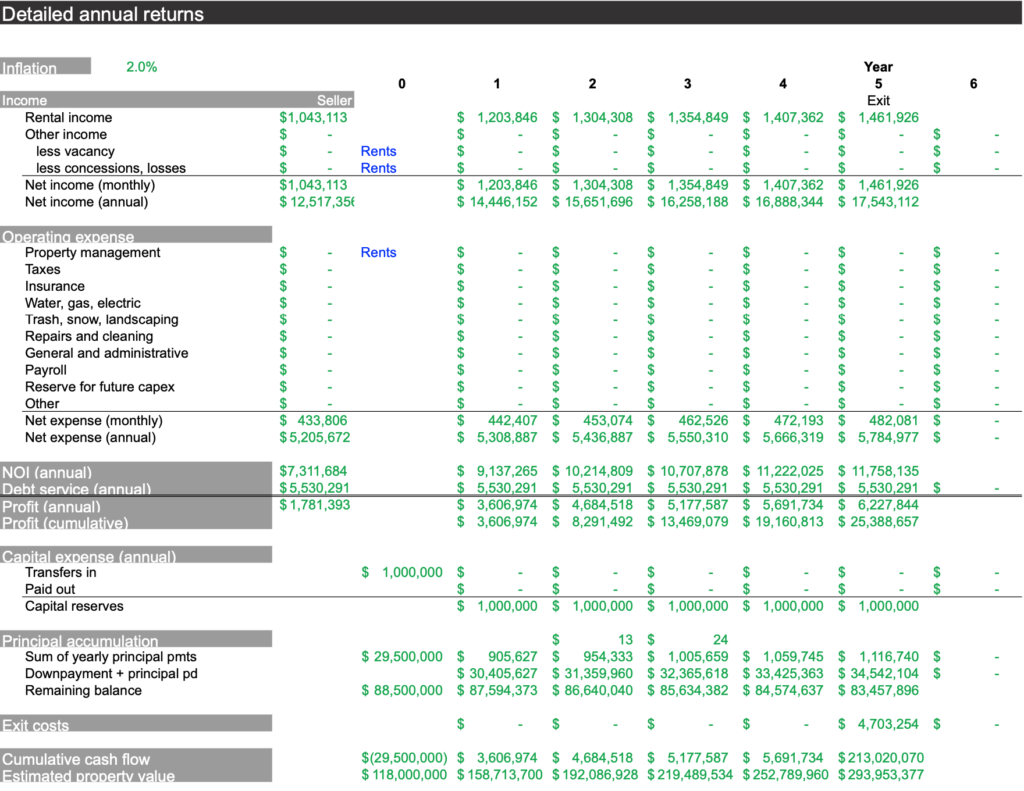

Below is a snapshot of returns for a 677 unit property that we underwrote recently!

Returns are based off a five year hold period and increasing rents 8% per year.